Student debt has been an ongoing debate for my entire life, whether student loans can or can’t be forgiven. When I went to college myself, I found that many of my fellow students would base all of their financial and political opinions on ways to solve the crisis of student debt. The debate has made the two sides opposed to each other on principle. They do not work together to solve the problem and instead constantly fight about the question, “Should the government forgive student loan debt?”

I believe the debate is too focused on this question, this one and only solution that has been offered. The free market has the power to solve or relive issues like this if business owners can be careful. I believe a problem like student debt can be drastically improved by businesses that align their goals and products toward a sustainable future. To do that the company needs to be able to keep these ideals once the founders are no longer making key decisions.

Businesses exist to make money, but the individual people involved want to make good decisions. Individuals will make decisions that they believe are moral, and that is why small businesses can often stay on a moral path even if it isn’t as good for the bottom line. The trouble comes when a company is publicly owned or is large enough that key decisions are being made to appease the bottom line. Good people who want to do the right thing will then start making decisions based on their fiduciary duty to the company instead of for the greater good.

Consider colleges for instance. Once fiduciary duty is governing the decisions of the college, they have two ways of making money. They can increase tuition, or they can admit more students. The trouble is, a college cannot admit more students endlessly. There is only so much housing near a school, only so many students a professor can teach at a time, and only so many students that can be handled administratively. That means colleges hit a cap regularly on how many students they can admit, and the only way to fulfil their fiduciary duty is to increase the price of tuition. Student loans are offered to decrease the burden of this high tuition on students, but in effect they have allowed colleges to increase prices more easily by using the loans as a subsidy. Furthermore, increases in the price of tuition can be a tool to limit the number of applicants to a college so the high prices can offset the need for higher admittance. As demand for college increases, supply cannot increase at the same rate, which results in much higher prices as time goes on.

Of course, the college can improve their bottom line by cutting costs instead of increasing revenue. To do that, they can put more students in the same class, resulting in a less useful generalized education. They can get rid of their buildings and offer education online, but that will be much less useful to many kinds of learners. These are just some examples, but the way colleges can cut costs are generally bad for the quality of education.

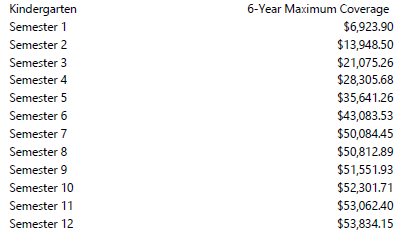

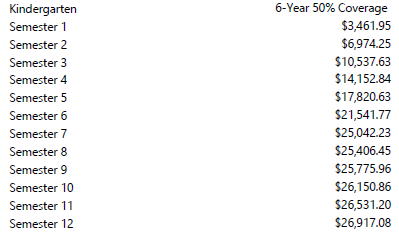

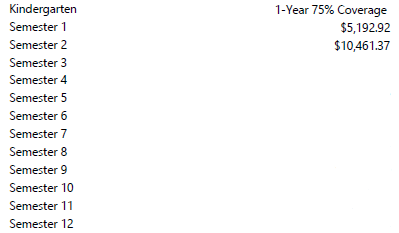

In contrast, Studious Solutions is a low-cost producer that relies on scale. The price of our plans is relative to the probability of students dropping out of their degree programs, which means we cannot increase prices beyond a certain point for our products to make any financial sense. Studious makes more money by selling more policies at a low cost, which will keep us from becoming a predatory company even when all the key decision makers change. To increase revenue for Studious, future decision makers will have to focus on selling more policies.

What about decreasing costs for Studious? Similar to the prices of our plans, the expenses to Studious are linked to the probability of students dropping out. That means we cannot cut costs by reducing the quality of our products. Instead, future decision makers for Studious will have to cut costs by making students less likely to drop out of college with initiatives like free academic counseling, tutoring for underperforming students, or aid programs that allow injured students to attend regular classes.

The student debt complex is a mess of colleges and loans that have opted to prey on students. Studious can fit into the complex without derailing the existing industry, and therefore without ruffling the feathers of these large profit driven institutions. Studious can provide relief to the students and their families. We can structure ourselves in a way that will force us to always help our customers, even when I am no longer making the decisions.

I believe the problems of a free market can be solved like this, with good natured clever people setting up the next generation to be a little better than the last, and to ease these problems where we can instead of looking for an all or nothing solution.